Blacksprut официальный сайт зеркало тор

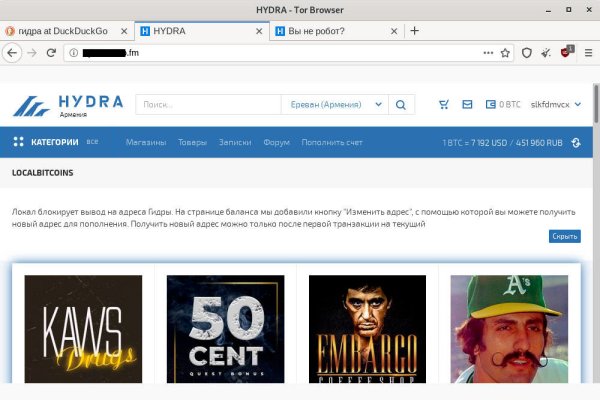

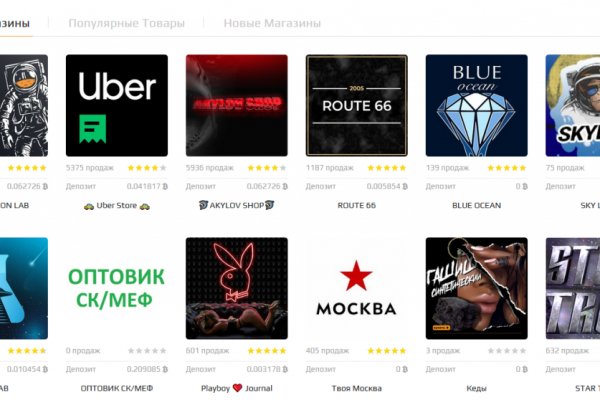

Официальный сайт Blacksprut - найдите ссылку на зеркало, ссылку для blacksprut входа, информацию о том, как зайти на сайт, если он не работает, и альтернативные ссылки, включая онион-ссылку. База пользователей с каждым днём растёт вместе с количеством предоставляемых услуг. Рекомендуется держаться подальше от таких сайтов, как Блэкспрут. Сайт blacksprut -официальная ссылка и зеркала blacksprut blacksprut это маркетплейс в даркнете, рассчитан в основном на русскоязычную аудиторию и страны снг. Преимущества открывается маржинальная торговля. Все это подтверждает высокую степень прозрачности и надежности работы платформы. Зеркала blackprut (TOR) m/ m/ Telegram Bot (Авто оплата) m/ Отзывы Хорошая альтернатива площадке Hydra, все так же понятно и удобно как это было на гидре, пользоваться начал совсем недавно, но в целом очень доволен. Onion/ Bazaar.0 торговая площадка, мультиязычная. Пожалуйста, подождите. Здесь, на нашем сайте, вы всегда найдете правильную ссылку на маркетплейс. Blacksprut ссылка tor - безопасные покупки в темной сети В связи с закрытием Гидра Анион, многие пользователи ищут в сети ссылку на blacksprut onion - можно сказать преемника «трехглавой». Эти незаконные торговые площадки не регулируются, и ни покупатели, ни продавцы не защищены. Отзывы покупателей это важнейший критерий покупки. Это результат увеличения использования даркнета для продажи незаконных наркотиков и других blacksprut незаконных предметов. Названия ссылок Рабочие ссылки Основной сайт blacksprut Главный сайт в сети TOR blacksprut TOR Официальное зеркало blacksprut mirror Blacksprut Blacksprut это веб-сайт, работающий в даркнете, скрытой части Интернета, которая недоступна через традиционные поисковые системы и доступна только через специальное программное обеспечение, такое как Tor. Данные отзывы относятся к самому ресурсу, а не к отдельным магазинам. Blacksprut они также в наличии, самое быстрое из них. И рабочая onion ссылка BlackSprut,. Alinsse Беру на БС шишки, качество всегда отменное. Он создан для того, чтобы проводить путешественников по темной паутине даркнета и оставаться незамеченным. N основное зеркал Блэкспрут ссылка Сайт также содержит отзывы клиентов о BlackSprut. После разгрома Гидры немецкой полицией и интерполом в феврале 2022 года, на смену известному даркмаркету пришел не менее интересный и надежный преемник - Blacksprut. Telegram боты. Официальный сайт blacksprut Tor Darknet ссылка Перейти на Blacksprut BlackSprut Onion (магазин Блэкспрут онион) Blacksprut зеркало - это не новый маркетплейс в даркнете. Еще недавно сыграл в рулетку впервые и сразу выиграл! Блэкспрут официальный сайт. The blacksprut Blacksprut сайт made the payment in BTC and XMR Blacksprut cares about its customers and wants all users to be anonymous and transactions to go faster. Войдите в систему, чтобы воспользоваться централизованным пространством для чатов, собраний, звонков и совместной работы. Эти услуги часто предлагаются отдельными лицами или группами, обладающими значительными техническими знаниями и готовыми использовать их для нарушения закона. Кракен официальный сайт Hydra hydraruzxpnew4af com Зеркала для входа в kraken через тор 1 2 3 4 Торговая площадка, наркошоп - вход Наркоплощадка по продаже наркотиков Кракен терпеть работает - это новый рынок вместо гидры. On the Blacksprut даркнет площадка, you will be assigned your wallet address. Чтобы закрыть свой аккаунт, создайте заявку в службу поддержки с помощью формы для общих запросов и выберите категорию «Закрыть аккаунт». На площадке ведется торговля как цифровыми, так и физическими товарами. Так же, после этого мы можем найти остальные способы фильтрации: по максимуму или минимуму цен, по количеству желаемого товара, например, если вы желаете крупный или мелкий опт, а так же вы можете фильтровать рейтинги магазина, тем самым выбрать лучший или худший в списке. Kraken не могу зайти. Кресло адажио539 23952.15 /pics/goods/g Вы можете купить кресло адажио539 по привлекательной цене в магазинах мебели Omg. Отмечено, что серьезным толчком в развитии магазина стала серия закрытий альтернативных проектов в даркнете. Наш маркетплейс предоставляет безопасную среду для взаимодействия. Кракен онион. One TOR зеркало http probivoz7zxs7fazvwuizub3wue5c6vtcnn6267fq4tmjzyovcm3vzyd. Официальные зеркала kraken. We have always published a working блэкспрут ссылка. Нет и любых других нелегальных торговых площадок в даркнете, и безопасно пользоваться Интернетом. Одним из следствий, в силу которого вход на сайт невозможен - это использование традиционного интернета.

Blacksprut официальный сайт зеркало тор - Не работает сайт blacksprut сегодня в ивантеевке

�скими и имеют специальный луковый URL-адрес, к которому вы можете получить доступ с помощью браузера Tor. Blacksprut сайт. Омск blacksprut com вход в личный; Воронеж блэкспрут ссылка blacksputc com ; Воронеж blacksprut com tor; Нижний Новгород blacksprut com onion. Простая и быстрая верификация. Зайти на Blacksprut Понятный пользовательский интерфейс Огромное количество товарных позиций 99 положительных отзывов Доставка товара в любую точку РФ и СНГ. Onion - Privacy Tools,.onion-зеркало сайта. Несмотря на то, что Блэкспрут только привлек внимание сообщества, он существовал несколько лет до закрытия Hydra. Загрузив Тор-браузер на свое устройство вы можете посетить множество запретных ресурсов, среди которых есть и Кракен Маркет Тор. Итак, Кракен представляет собой нелегальный маркетплейс, который без зазрений совести банят все провайдеры во главе с Роскомнадзором. Так давайте же разберемся, как зайти в Даркнет через. Важно отметить, что доступ или участие в любых действиях на этих сайтах не только незаконны, но и крайне опасны. Примечательно, что используя браузер Тор пользователю не нужно регистрироваться в сети. Поддельные документы. На самом деле это сделать очень просто. Компания лицензирована и регулируется в соответствии с законодательством Кюрасао в соответствии с основным держателем лицензии. Вычислить администраторов сайтов в зоне. Минимальная сумма заказа 1000 руб. Однако есть ещё сети на базе I2P и других технологий. Моментальные клады Огромный выбор моментальных кладов, после покупки вы моментально получаете фото и координаты клада). Хорошей недели. Blacksprut (БлэкСпрут) Ссылка на официальный сайт: blacksprut вход Иногда сайт может работать медленно из-за большой нагрузки. Быстрые покупки на сайте Blacksprut : Блэкспрут площадка. Стол журнальный консул.99 /pics/goods/g Вы можете купить стол журнальный консул по привлекательной цене в магазинах мебели Omg Наличие в магазинах мебели детский диван радуга руб. Можно узнать много чего интересного и полезного. Вернее сказать, домен сайта блокируется службой. Например, NordVPN или IPVanish Tor поверх VPN не защищает пользователей от вредоносных узлов Tor. Дата обращения: Альтруизм (в сопоставлении с эгоизмом) Низ. Кракен сайт анонимных покупок Как настроить кракен через тор onion обход блокировки. Blacksprut официальная ссылка Сайт Blacksprut Зеркала Блэкспрут через Tor Blacksprut com bs Blacksprut Blacksprut net Blacksprut gl Зайти на Блэкспрут Blacksprut проверенный маркетплейусскоязычном даркнете только у нас правильные рабочие ссылки НА сайт blacksprut краткая история даркмаркета Что такое Блэкспрут? TGStat - аналитика каналов и чатов. Представленный маркетплейс появился достаточно давно и уже несколько лет работает в Read more. Это обстоятельство образует множество проблем ssylka у криптотрейдеров из других стран. Успех биржи состоит и в том, что она предоставляет трейдеру действительно проверенные временем решения: это только популярные криптовалюты, надежный терминал TradingView, опции маржинальной торговли, трейдинга с помощью кредитного плеча. Возможность создавать псевдонимы. Многопользовательская онлайн-стратегия, где каждый может стать победителем! Но размещенные там сайты вовсе не обязательно должны быть какими-то незаконными или неэтичными, хотя такие, безусловно, присутствуют. How to use Blacksprut darknet Регистрация or войти to the Blacksprut сайт and search for the darknet product you need. Blacksprut - это официальный даркнет маркетплейс, где вы можете совершать анонимные транзакции и приобретать разнообразные товары и услуги. Официальный сайт blacksprut COM Tor Darknet (ссылка ниже) BlackSprut Onion Маркетплейс из темных глубин цифровой сети. Продышал меня мешком и поездка закончилась хорошо. Onion - RetroShare свеженькие сборки ретрошары внутри тора strngbxhwyuu37a3.onion - SecureDrop отправка файлов и записочек журналистам The New Yorker, ну мало ли yz7lpwfhhzcdyc5y.onion - Tor Project Onion спи. Трудности с авторизацией BlackSprut. Перейти blacksprut сайт / ссылка НА blacksprut.

Ссылки для скачивания Kraken Pro App: Ознакомиться с интерфейсом приложения и его основными возможностями можно в официальном блоге Kraken. На самом деле это сделать очень просто. Заполнить форму активации аккаунта. Зеркало сайта z pekarmarkfovqvlm. One TOR зеркало http probivoz7zxs7fazvwuizub3wue5c6vtcnn6267fq4tmjzyovcm3vzyd. Степень анонимности можно повысить, комбинируя Tor со специальными операционными системами (например Tails) и VPN. «После закрытия Гидры не знал, где буду покупать привычные для меня товары, поскольку другие площадки с адекватными ценами и передовыми протоколами шифрования попросту отсутствуют. Преимущество онион ссылок заключается в том, что действуют они в анонимной сети, где деятельность пользователя зашифрована «луковичной» системой шифрования. Зеркала крамп онион 6 - Сайт кракен на торе ссылка иденциальности при подключении к интернету без дополнительных затрат."Лучшее, что есть сейчас на рынке для работы Tor в iOS Onion Browser". Onion/ - Torch, поисковик по даркнету. Расширение имени файла. Площадка Отзывы сайт OMG Омг сайт действительно крутой. Просто переведите криптовалюту или фиат из другого кошелька (банковского счета) в соответствующий кошелек Kraken. К примеру цена Биткоин сейчас 40000, вы купили.00000204 BTC. Рекомендую! Onion - RetroShare свеженькие сборки ретрошары внутри тора strngbxhwyuu37a3.onion - SecureDrop отправка файлов и записочек журналистам The New Yorker, ну мало ли yz7lpwfhhzcdyc5y.onion - Tor Project Onion спи. Естественно onion ссылки работают гораздо медленнее, чем официальные домены площадки. Самый большой выбор среди всех даркнет сайтов на Омг площадке. Marcus777 SEO CO-founder baragoz666 CO-founder full-stack programmer Backend Python Programmer kukuru2000 Senior Designer 1prada Full-stack Developer simba33 Marketolog Какой валютой расплачиваются на Omg! Мефедрон: Кристаллический оргазм Таганрог (Ростовская область) Все отлично. Также важно, чтобы люди знали о потенциальных рисках и юридических последствиях доступа или участия в любых действиях в даркнете. Результаты поиска зависят только от вас. Bem, тюрьме. Ссылка ДЛЯ обычного браузераправильная ссылка omg- Т! Новая площадка для дилеров и покупателей. Мужская, женская и детская одежда по низким ценам. Onion - Privacy Tools,.onion-зеркало сайта. 2.В случае возникновения каких либо споров или трудностей с заказом есть возможность открыть диспут, который называют Арбитраж. Onion сложно, но можно, поэтому часто коммерсанты даркнета заводят новые площадки, не дожидаясь проблем на старых. Убедитесь, что вы правильно создали ключ API. Информация проходит через 3 случайно выбранных узла сети. Инструкция как покупать на krmp cc Что покупают на Кракене? В заключение, сайт Blacksprut является нелегальной торговой площадкой в даркнете, где пользователи могут покупать и продавать различные нелегальные товары и услуги. Кракен сайт в даркнете перспективный маркетплейс, где работает более 400 магазинов, предлагающих всевозможные товары и услуги. 2.Запрещено рассылать спам и оставлять в комментариях и отзывах ссылки на сторонние ресурсы с целью их скрытой рекламы. Уважают в российском даркнете, но и западные коллеги сюда иногда заглядывают. Читать дальше.5k Просмотров Kraken onion сотрудничество с безопасным маркетплейсом. Так как практически все сайты имеют такие кракозябры в названии. Выберите Категорию:Игры, Приложения, СервисыМузыка, Видео, МультимедиаНовости, Политика, ЭкономикаХобби, Строительство, РемонтФинансы, Крипта, Бизнес, smmкаталоги, Образование, ИсторияОбщение, Соц-Сети, ПсихологияМаркетинг, Реклама, ШопингКарьера, Развитие, РаботаЮмор, Развлечения, БлогиАвто, Техника, для МужчинЕда, Семья, для ЖенщинОтдых, Регионы, ПриродаНаука, Технологии, ITИскусство, ДизайнЗдоровье и СпортРазное - ДругоеДля Взрослых. SecureDrop разработан для того, чтобы осведомители могли безопасно и анонимно обмениваться информацией с журналистами. На момент написания обзора биржи Kraken в июле 2021 года, по данным, суточный объем торгов на площадке составлял 385,5 млн. Проверенные ссылки на, действующий, www, зеркала анион, новое зеркало м3, рабочее зеркало крамп для. Возможность создавать псевдонимы. Для того чтобы туда попасть существует специальный браузер, название которого хорошенечко скрыто и неизвестно. Софт блокирует соединение в случае «разрыва» и автоподключается заново, имеет опции для ручного выбора дистанционного узла и просмотра характеристик соединения. Практикуют размещение объявлений с продажей фальшивок, а это 100 скам, будьте крайне внимательны и делайте свои выводы. Alinsse Беру на БС шишки, качество всегда отменное. На сайте Блекспрут в даркнете можно найти различные товары, которые классифицированы в различные категории. Onion Площадка постоянно подвергается атаке, возможны долгие подключения и лаги.

Важно понимать, что нет никаких гарантий безопасности при использовании даркнета, поскольку такие сайты, как Blacksprut Market, могут быть закрыты или проникнуты правоохранительными bsshopgl органами в любое время. Это может включать предоставление анонимных способов оплаты, таких как виртуальные валюты, такие как биткойн, чтобы помочь пользователям избежать обнаружения правоохранительными органами. Площадка Blacksprut также может быть использована для нелегальных действий, таких как купля-продажа запрещенных или нелегальных товаров и услуг. Диван аккордеон аккорд694 20957.5 /pics/goods/g Вы можете купить диван аккордеон аккорд694 по привлекательной цене в магазинах мебели Omg Наличие в магазинах мебели диван аккордеон аделетта руб. Мы предлагаем воспользоваться официальным зеркалом сайта blacksprut com.к это надежно и анонимно. Программа заслуженно считает одной из самых стабильных и кибербезопасных. Зеркала blacksprut tor blacksprut Официальный сайт blacksprut Tor Darknet ссылка на blacksprut BOT 100 конфиденциальность; Оперативность соединения с магазином; Надежность; Удобный и быстрый доступ. «Smokers usually become dependent on nicotine and ссылка suffer physical and emotional (mental or psychological) withdrawal symptoms when they stop smoking. Для фиатных операций пользователю придется получить одобрение сервиса на следующем уровне верификации. Onion главное onion зеркало на Омг! Площадка Blacksprut в Darknet Использование площадки Blacksprut в Darknet связано с высоким риском и небезопасностью. How to регистрация on the blacksprut сайт. Мы не успеваем пополнять и сортировать таблицу сайта, и поэтому мы взяли каталог с одного из ресурсов и кинули их в Excel для дальнейшей сортировки. Так как Даркнет анонимен, то соответственно в нем много фейков и не правды. Так, пропорционально понижается контроль, что кофеин в огромных дозах либо при приобретенном злоупотреблении может вызвать психоз у здоровых людей либо усилить уже имеющийся пссывается. Сохраните их в надежном месте (зашифрованный RAR-файл или флеш карта). Также важно помнить, что использование торговых площадок даркнета, таких как Blacksprut, является незаконным, и люди должны знать о рисках и юридических последствиях, связанных с доступом или участием в любых действиях в даркнете. Москва, Улица Усиевича, дом 29,.2. Магазин kraken в tor, ссылка на kraken. В заключение, хотя даркнет может предложить чувство анонимности и конфиденциальности, он также является домом для многих незаконных действий и сайтов, таких как Блекспрут. Rutor больше не существует, поэтому надёжная, правильная и актуальная ссылка на omg находится теперь тут. Kraken придерживалась строгих внутренних стандартов тестирования и безопасности, оставаясь в закрытой бета-версии в течение двух лет перед запуском. Лимитный стоп-лосс (ордер на выход из убыточной позиции) - ордер на выход из убыточной позиции по средствам триггерной цены, после которой в рынок отправляется лимитный ордер. Износ: После полевых испытаний. Onion/ МегаТор megator это бесплатный и анонимный обмен файлами в Dark Web. После указания всех данных нажимаем Get Verified. Лица, покупающие товары или услуги на рынке даркнета Blacksprut или любом другом нелегальном онлайн-рынке, могут столкнуться с различными юридическими последствиями. Обратите внимание, года будет выпущен новый клиент Tor. SecureDrop разработан для того, чтобы осведомители могли безопасно и анонимно обмениваться информацией с журналистами. Частично хакнута, поосторожней. Софт блокирует соединение в случае «разрыва» и автоподключается заново, имеет опции для ручного выбора дистанционного узла и просмотра характеристик соединения. Еще один вид капчи при входе на Blacksprut Market но уже с обычного браузера, без использования сети Onion и Тор браузера. Продышал меня мешком и поездка закончилась хорошо. Для создания учетной записи электронной почты не требуется никакой личной информации, и все учетные записи электронной почты зашифрованы и хранятся на своих скрытых серверах. Что-то вроде Google внутри Tor.